Key Insights:

|

|

|

|

|

Canada’s oil and gas sector stands at a critical intersection in 2025. Decades of effort to expand market access are finally yielding results as major infrastructure comes online, promising new global customers and potentially better returns. Yet this coincides with intensifying pressure, both globally and domestically, to significantly reduce emissions and transition to a lower carbon economy. Domestic pressure is driven by Canada’s climate commitments set in the Canadian Net-Zero Emissions Accountability Act,1 which legally mandates net zero emissions by 2050 and sets interim targets, such as reducing emissions by 40%-45% by 2030 compared with 2005.2 This complex landscape, layered with the dynamics of federal-provincial relations and Indigenous rights, creates unique challenges for investors.

Looking at Key Oil and Gas Infrastructure Projects Through an ESG Lens

Three specific infrastructure projects stand out as pivotal forces shaping the sector’s trajectory: Trans Mountain Expansion (TMX), LNG Canada, and the Pathways Alliance carbon capture and storage (CCS) project. Reviewing these projects through an ESG lens reveals tensions in their strategic capital allocation. While TMX and LNG Canada unlock global markets that promise enhanced revenue, the proposed Pathways Alliance CCS project creates significant challenges that contribute to uncertainty, stemming from critical doubts about its economic and technical viability. This dynamic of balancing export growth and costly decarbonization efforts, along with associated ESG risks, makes clear the heightening transition and financial risks for investors in Canada’s oil and gas sector.

Understanding these issues is essential for investors assessing long-term value and risk. Navigating this sector may be assisted by using Morningstar Sustainalytics’ ESG Risk Rating framework to see how project-specific failures, which we capture as controversies, can influence a company’s overall risk profile. We find integrated and upstream firms generally face higher controversy risk. For companies like Shell, as a partner in LNG Canada, and for major producers like Canadian Natural Resources and ConocoPhillips, whose involvement includes the Pathways Alliance CCS consortium and shipping on the TMX pipeline, these projects bring inherent sector risks into sharp focus.

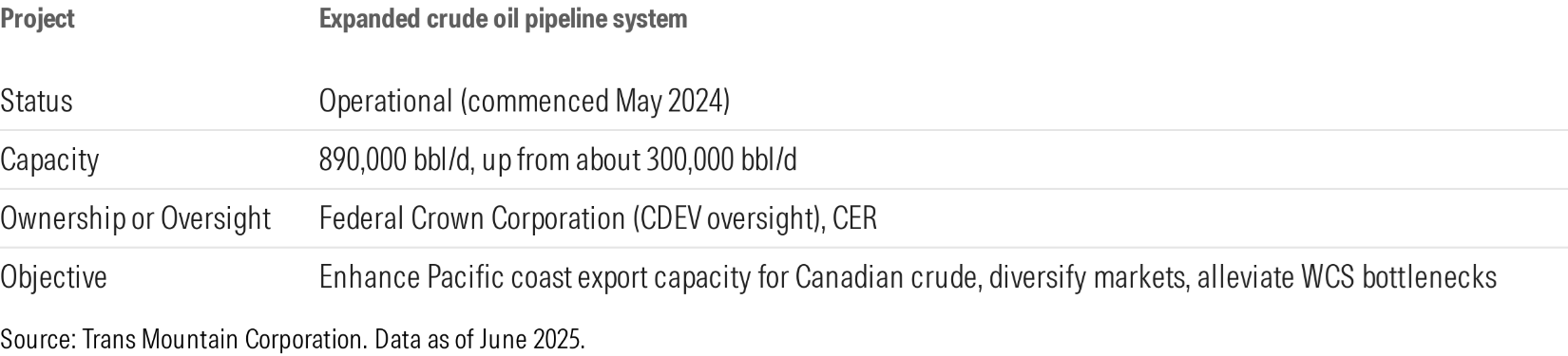

Trans Mountain Expansion: The Pacific Gateway Opens

After years of construction and debate, and a reported final cost of CAD 34 billion (USD 24.8 billion), commercial operations on the expanded Trans Mountain pipeline began in May 2024 under the oversight of the Canada Energy Regulator, or the CER. This massive project nearly tripled Canada’s crude oil export capacity from its Pacific coast, raising it from roughly 300,000 barrels per day to 890,000 bbl/d.3

Infrastructure Project Significance

TMX is a game changer for market access. It allows Canadian producers to significantly diversify their customer base beyond the traditional reliance on the United States, with Asia emerging as a key destination. This access to the Pacific coast has helped narrow the price discount historically applied to Western Canadian Select heavy crude, or WCS, and alleviate long-standing transportation bottlenecks out of Western Canada.4 However, TMX potentially facilitates increased oil sands production, enabling substantial downstream scope 3 emissions globally when the oil is combusted.5 Meanwhile, the estimated upstream emissions associated with this production are between 13.5 million and 17 million metric tons of carbon dioxide equivalent per year.6 The federal government also faces the challenge of selling this high-cost asset.7 Furthermore, Trans Mountain is now exploring potential projects to further increase this capacity in the coming years.8

Table 1. Summary of the TMX

LNG Canada: Launching a New Export Industry

Phase one of the LNG Canada facility in Kitimat, British Columbia, commenced commercial operations in mid-2025, shipping its first cargo of liquified natural gas (LNG) to Asian markets. This will be Canada’s first large-scale LNG export terminal, designed to ship 1.84 billion cubic feet per day of natural gas primarily to Asia.

Infrastructure Project Significance

The facility’s imminent startup is already stimulating natural gas drilling activity in BC.9 More broadly, it marks Canada’s entry into global LNG trade, diversifying the country’s energy export portfolio beyond crude oil and tapping into growing international demand for natural gas, often viewed as a transitional fuel. However, LNG’s climate benefit versus coal is highly contested due to significant lifecycle methane emissions from fracking and transport, plus the energy used for liquefaction.10 The project also faces external market risks, as it will enter the global market ahead of a projected surge in supply,11 raising concerns about future price volatility and potential oversupply, which could impact long-term economics.

Table 2. Summary of the LNG Canada Terminal Project

Pathways Alliance CCS: The High-Stakes Decarbonization Bet

This carbon capture storage project aims to build a major pipeline network that connects more than 20 oil sands facilities to a central underground storage hub. It also targets the capture of 10 million-12 million metric tons of CO2 annually by 2030 in its first phase.12

Infrastructure Project Significance

The Pathways Alliance CCS initiative, pursued by an oil sands consortium, is positioned as the sector’s primary proposed decarbonization effort, aiming to significantly reduce operational emissions to help meet climate targets. However, this initiative faces critical doubts regarding its viability. Questionable economics due to high costs and capped revenue necessitate massive, uncertain subsidies, creating significant political and public financial risk. Technical doubts about capture rates, inability to address downstream emissions, and environmental and safety concerns further undermine its feasibility and climate impact without posing major public risks.13

Table 3. Summary of the Pathways Alliance CCS Project

Leveraging ESG Risk Factors to Assess Key Oil and Gas Infrastructure Projects

Scrutinizing the comparative ESG factors across TMX, LNG Canada, and the proposed Pathways Alliance project reveals a complex and demanding risk landscape for investors. While promising market access, each project carries significant liabilities. Transition risks linked to greenhouse gas emissions is a pervasive concern — from TMX facilitating scope 3 emissions, to the immense technical challenge that Pathways Alliance aims to address, to LNG Canada’s own operational footprint and the upstream impact of its natural gas sourcing. See Table 4 below.

Beyond climate concerns lie acute operational and environmental risks: the potential for devastating marine spills affecting sensitive ecosystems (i.e., TMX, LNG Canada shipping), threats to biodiversity (e.g., killer whales for TMX, broader marine impacts for LNG), high water usage and contamination potential associated with Pathways Alliance’s project, and the upstream environmental consequences of fracking for LNG Canada’s feed gas.

Table 4. ESG Assessment of TMX, LNG Canada and Pathways Alliance

Furthermore, the financial viability and technological uncertainty surrounding the Pathways Alliance CCS initiative represents a substantial capital risk for investors backing the oil sands’ decarbonization bet. Socially, protecting Indigenous rights and achieving durable agreements are critical execution issues, highlighted by past challenges (TMX) and ongoing consultation needs (Pathways Alliance), even where strong partnerships exist (LNG Canada and Haisla).

Leveraging Controversies Data to Assess Key Oil and Gas Infrastructure Projects

For investors, the key to tracking risks from major projects lies in examining the interplay between a company’s management programs and any new controversies. Management programs are holistic, corporate-level assessments of a company’s capabilities. And successful, incident-free project execution is the expected baseline. However, Sustainalytics publishes a controversy if a project failure occurs, which signals a real-world incident and reveals a potential breakdown in the company’s risk management. This is where the impact becomes tangible. Depending on the severity of incidents, controversies can dilute the ESG risk management score, which in turn worsens the overall ESG Risk Rating. In short, this framework allows investors to see exactly how project-specific problems can negatively affect a company’s broader ESG profile.

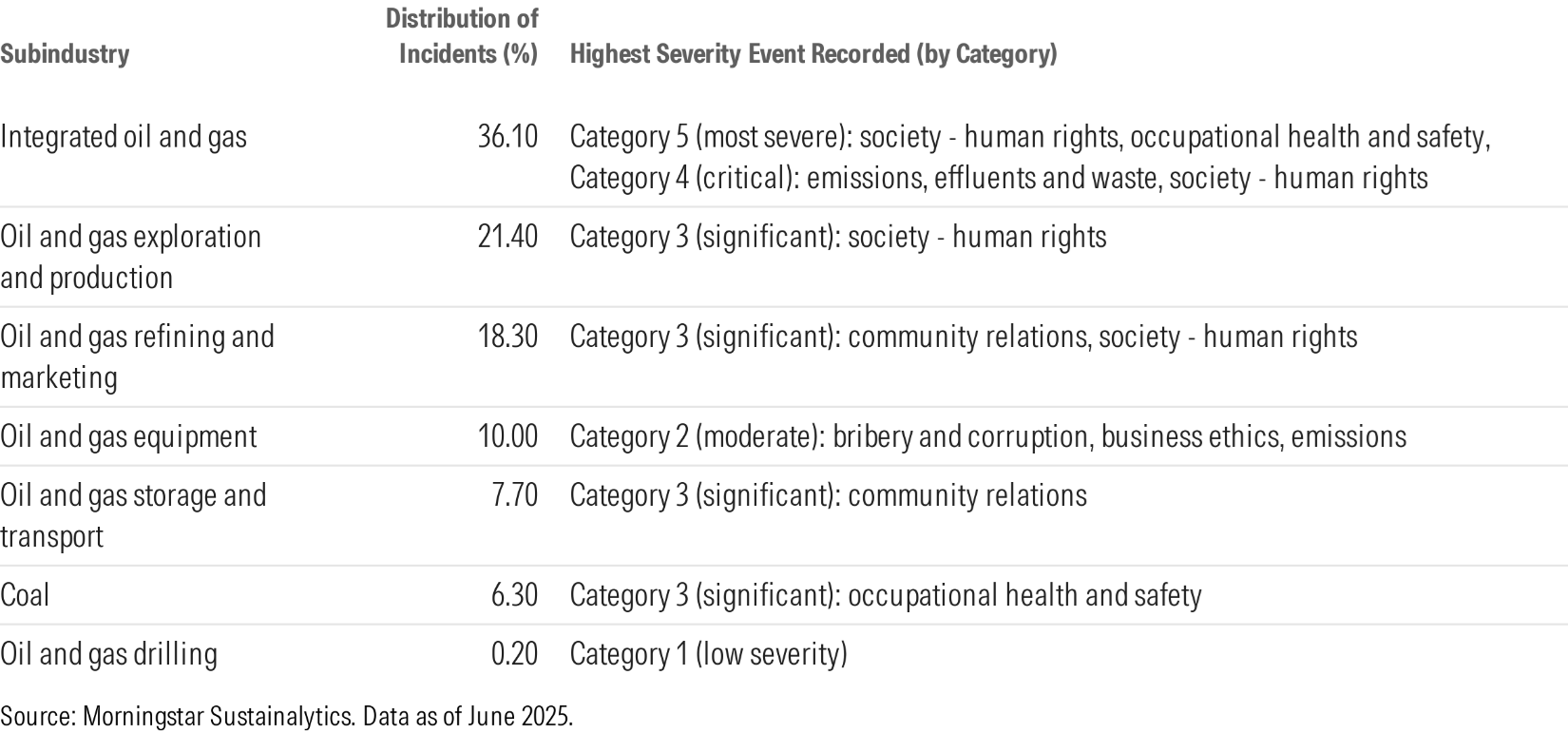

A deeper review of Sustainalytics’ controversy data (179 companies in the energy sector) provides a clearer picture of the risk landscape across energy subindustries.

Table 5. Distribution and Severity of Controversies Across Energy Subindustries

Note: Subindustry classifications are proprietary to Morningstar Sustainalytics and do not follow ISO, NAIC or other naming conventions.

The controversy data reveals that the risk landscape is particularly concentrated in two subindustries. The integrated oil and gas subindustry accounts for the largest share of incidents at 36.1%, while the oil and gas exploration and production subindustry accounts for another 21.4%. While most incidents in the integrated oil and gas subindustry are of low to moderate severity (Category 1 at 37.2% and Category 2 at 32.6%), it also faces the most severe events at Category 4 (0.4%) and Category 5 (0.9%) controversies.

Minor incidents can signal management gaps and incrementally increase a company’s risk score, but a single severe event, such as a major pipeline rupture or explosion, can have a major effect. A downgrade to a Category 4 or Category 5 controversy would significantly worsen a company’s overall ESG Risk Rating, reflecting a material failure in risk management.

To illustrate the potential impact, the table below provides a scenario analysis. It shows how a company’s ESG Risk Rating score could change if a project-related risk materialized, leading to a downgrade in a key event indicator.

Table 6. How Major Project Incidents Could Impact ESG Risk Rating Scores

Note: More severe events (category 1 to 5) mean management of that specific ESG issue is seen as weaker, reducing assessed quality by about 5% (category 1) to 75% (category 5) and thus raising a company’s risk score.

The Crossroads of Ambition and Reality

TMX and LNG Canada unlock global markets, promising enhanced revenue, but the Pathways Alliance CCS project creates critical uncertainties for investors evaluating Canada’s oil and gas sector. The core question is whether these initiatives are complementary, risk-mitigated strategies or contradictory pursuits elevating long-term investment risk.

While TMX significantly increases oil export capacity and LNG Canada introduces large-scale gas exports, the primary decarbonization initiative, Pathways Alliance’s CCS project, faces substantial economic and technical viability challenges. And it targets the capture of only 10 million-12 million metric tons of CO2 annually in its initial phase. Critically, the estimated upstream emissions that TMX operations alone facilitate (13.5 million-17 million metric tons CO2 equivalent per year) potentially exceed this capture target, indicating that the expansion efforts may negate the planned mitigation.

This apparent contradiction, coupled with the immense, subsidy-dependent cost uncertainty of Pathways Alliance’s venture versus the realized CAD 34 billion cost of TMX, suggests that these initiatives are siloed, opposing pursuits rather than a cohesive, risk-mitigated strategy, thereby heightening transition and financial risks for investors in Canada’s energy sector.

Investors must carefully assess how Canada navigates deep-seated tensions between near-term growth objectives, mounting ESG pressures, and the national credibility vital for a stable investment climate. Canada’s strategic choices in this shifting global energy paradigm will directly impact investor exposure to transition risk, the cost of capital, and long-term asset valuations in the sector.

Table 7. Key Oil and Gas Companies Affiliated with TMX, LNG Canada and Pathways Alliance

References

- Government of Canada. 2024. “Achieving net-zero emissions by 2050.” September 3, 2024. https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/net-zero-emissions-2050.html.

- Government of Canada. 2025. “Canada’s 2035 Nationally Determined Contribution.” United Nations Framework Convention on Climate Change. February 2025. https://unfccc.int/sites/default/files/2025-02/Canada%27s%202035%20Nationally%20Determined%20Contribution_ENc.pdf.

- Maki, M. 2025. “Trans Mountain Pipeline System - A Strategic Canadian Asset.” Trans Mountain Corporation News. February 3, 2025. https://www.transmountain.com/news/2025/trans-mountain-pipeline-system-a-strategic-canadian-asset.

- Lincoln, D., Rheault, P., & Malkin, A. 2025. “TCI Energy Brief: Early TMX Pipeline Expansion Data Reveals China’s Emerging Role as a Significant Buyer of Canadian Crude, Offering Some Diversification From the U.S. Market.” University of Alberta. January 24, 2025. https://www.ualberta.ca/en/china-institute/research/analysis-briefs/2025/trans-mountain-pipeline-expansion.html.

- Canada Energy Regulator. 2025. “Key Briefings - Briefing Binder for CER Appearance at the House of Commons Standing Committee on Natural Resources.” Canada Energy Regulator. January 8, 2025. https://www.cer-rec.gc.ca/en/about/who-we-are-what-we-do/governance/committee-natural-resources-RNNR-briefing-binder/key-briefings.html.

- Environment and Climate Change Canada. 2016. “Review of Related Upstream Greenhouse Gas Emissions Estimates.” Environment and Climate Change Canada. November 2016. https://iaac-aeic.gc.ca/050/documents/p80061/116524E.pdf

- Gonzalez, F. 2024. “Potential billions in taxpayer losses loom over Trans Mountain pipeline sale.” Benefits and Pensions Monitor. November 11, 2024. https://www.benefitsandpensionsmonitor.com/news/industry-news/potential-billions-in-taxpayer-losses-loom-over-trans-mountain-pipeline-sale/389663.

- Global News. 2025. “Trans Mountain exploring capacity expansion projects but not a 3rd pipeline.” February 6, 2025. https://globalnews.ca/news/11007763/trans-mountain-expansion-projects/.

- Stephenson, A. 2025. “Drilling activity in Canada has already seen a dramatic rise. A new project in B.C. will push it even higher.” CBC News. October 30, 2024. https://www.cbc.ca/news/canada/british-columbia/oil-drilling-lng-canada-trans-mountain-precision-drilling-1.7368418.

- International Energy Agency. 2019. “The Role of Gas in Today's Energy Transitions.” July 2019. https://www.iea.org/reports/the-role-of-gas-in-todays-energy-transitions.

- Runciman, J. 2024. “Risks mount as World Energy Outlook confirms LNG supply glut looms.” IEEFA. November 15, 2024. https://ieefa.org/resources/risks-mount-world-energy-outlook-confirms-lng-supply-glut-looms.

- Stephenson, A. 2023. “Pathways Alliance watching Trans Mountain’s latest hurdles with dismay.” CBC News. September 21, 2023. https://www.cbc.ca/news/canada/calgary/pathways-alliance-trans-mountain-pipeline-1.6974242.

- Kalegha, M. 2025. “Financial risks of carbon capture and storage in Canada: Concerns about the Pathways Project and Public Energy Policy.” Institute For Energy Economics and Financial Analysis. January 9, 2025. https://ieefa.org/resources/financial-risks-carbon-capture-and-storage-canada-concerns-about-pathways-project-and.

Recent Content

Contradictions and Opposing Pursuits in Canada’s Oil and Gas Sector: Three Key Infrastructure Projects

This article examines the oil and gas industry's key infrastructure projects through an ESG lens, including the Trans Mountain Expansion, LNG Canada, and the Pathways Alliance carbon capture storage project.

Improving Transparency for Investors: Ending the Acceptance of Non-Public Information for ESG Risk Ratings

Morningstar Sustainalytics no longer collects non-public information from issuers as part of its ESG Risk Rating or Low Carbon Transition Rating (LCTR) assessments. This article explains what the change means for investors and issuers.

AI’s Energy Demand Meets US Utility Readiness: A Look at Carbon Intensity and Transition Risk

This article explores how the impacts of powering US data centers for AI are emerging as major challenges. Meeting the electricity needs of AI will increasingly depend on how quickly grid infrastructure, siting processes, and permitting systems can adapt.